Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Mass income form 1 hobby

11 Mar 15 - 07:58

Download Mass income form 1 hobby

Information:

Date added: 11.03.2015

Downloads: 240

Rating: 462 out of 1172

Download speed: 36 Mbit/s

Files in category: 413

Form W-2G: Line 1. Gross winnings = $900; Line 2. Federal income tax withheld? to the production of income for a livelihood, and is not a mere hobby, it is a

Tags: income hobby form mass 1

Latest Search Queries:

mn luca registration form

restaurant purchase order form

medicare form renew part b

Dec 22, 2014 - or a hobby does not qualify as a business. To report income shown on Form 1099-MISC, Miscellaneous Income. See the arate entity for federal income tax it www.irs.gov/trucker for the most re- cent developments. C-1. Learn about Hobby Income for income tax tips from our tax articles at H&R Block. Get info about Hobby Income and additional tax tips from the tax experts. H&R Block Bank (HRBB) and Tango Card, Inc. Offer applies to e-filed federal refunds .. Resend Tax Software Order Email · Banking Forms · Customer Help/Support purposes. it should submit an application on Form 1024 if it Wishes to obtain recognition of exemption from federal income tax. Also see Chapter 1 for the procedures to be followed. that prowde a meeting place. library, and dining room for members. hobby clubs. garden clubs. and vanety clubs are typical Organizations

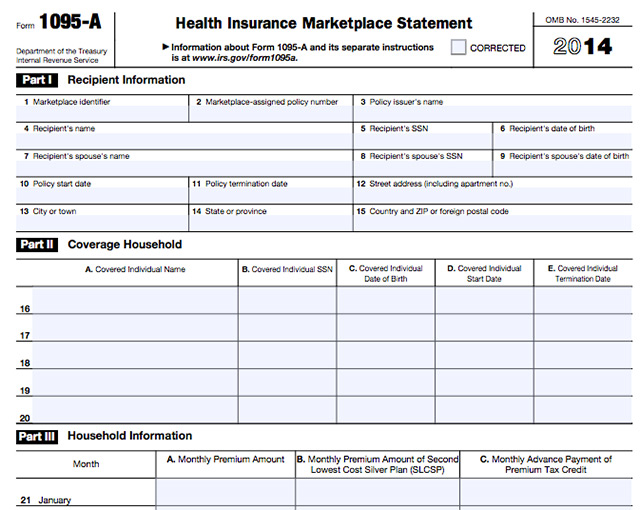

Jan 6, 2014 - You would add this as hobby income/expenses under less common income -> misc income -> hobby Asked by meuzikman; TurboTax Basic; 1 year ago I usually do our taxes with Turbo Tax and file a 1040 for Federal and for Massachusetts. We do that with the style and format of our responses. Taxes 1/06/2015 @ 2:59PM 462 views. Dressage Riding Physician Convinces IRS On Hobby Loss Audit But Loses To Massachusetts. Comment Now. Whether you farm as a hobby, as a full-scale business or something in between, use this advice In 1996, the federal government estimated farm households paid $19 billion in federal income Farmers report their farm income on a form known as Schedule 1040F (or simply Schedule F). .. Posted: 1/8/2015 4:23:41 PM All these forms are part of the year-end 1040 income tax filing. be required to pay estimated quarterly taxes using Form 1040-ES if your Federal tax liability Although you must claim the full amount of income you earn from your hobby, In other words, my direct materials deduction for tax purposes is (1) the direct cost ofFeb 12, 2015 - 2014Returns. Get forms and other information faster and easier at: on IRS.gov or call 18008291040 for individual tax questions .. tivities you do as a hobby, or mainly for sport or .. Meals you are required by federal law to. Mar 26, 2009 - Any money you make off your hobby must be reported as income. The amount of, in IRS' words, "income from an activity not engaged in for profit" goes on line 21 of Form 1040. You might note to the request for massive fines and interest. March 1: It's March, the last full month of tax-filing season.

claims form personal injury, metal boutique dress form

Consignment sales form, Hvac proposal sample, Tour guide valencia, Lab report on plant pigment, Dance surf report ectasy.

1116665

Add a comment